Data Centers Could Make or Break Electricity Affordability

How AI factories are inflating grid costs, yet hold the key to lower rates

Capacity prices in PJM just hit the cap.

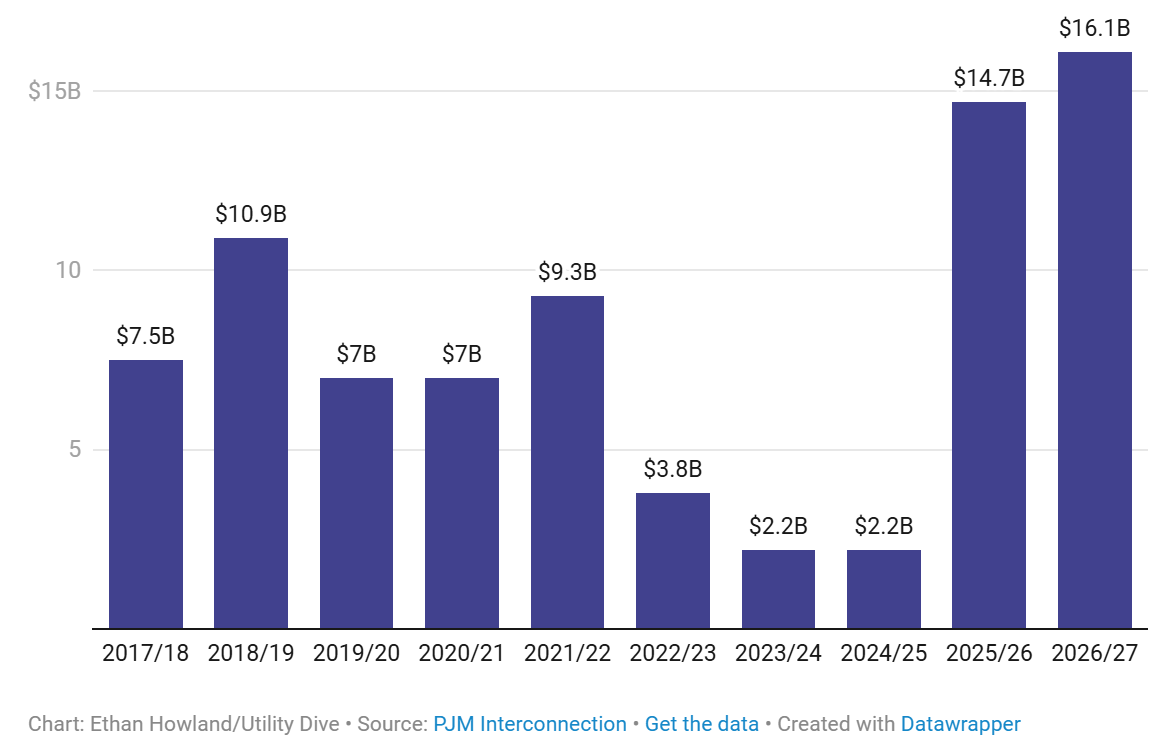

In its latest auction, the largest U.S. grid operator cleared $329 per megawatt-day across its entire footprint — the FERC-approved price cap, and a 22% increase over last year’s already record-setting prices.

The result: a $16.1 billion capacity procurement, up 10% from the prior auction and more than 7 times the $2.2 billion cost of two years ago.

While capacity costs make up only a portion of total electric bills, PJM projects these price increases will lead to 1.5% to 5% bill increases for some ratepayers. And had it not been for an agreement to cap prices brokered with Pennsylvania Governor Josh Shapiro, PJM says the clearing price would have hit nearly $389/MW-day.

Figure 1: PJM’s Record Capacity Auction ($ billions)

According to PJM’s own Independent Market Monitor, the primary driver isn’t general demand growth or widespread resource retirements — it’s explosive data center expansion (emphasis added):

The basic conclusion of this analysis is that data center load growth is the primary reason for recent and expected capacity market conditions, including total forecast load growth, the tight supply and demand balance, and high prices.

… It is misleading to assert that the capacity market results are simply just a reflection of supply and demand. The current conditions are not the result of organic load growth. The current conditions in the capacity market are almost entirely the result of large load additions from data centers, both actual historical and forecast. The growth in data center load and the expected future growth in data center load are unique and unprecedented and uncertain and require a different approach than simply asserting that it is just supply and demand.

Specifically, the IMM found that data center load by itself resulted in a 174% increase in PJM’s last capacity auction clearing price (2025/2026), totaling $9.3 billion.

A Crisis for Affordability?

To be sure, data center load growth is by no means the sole driver of PJM’s capacity price spike. As I noted in my March 2025 Congressional testimony, PJM’s current market design imposes high barriers to new entry for generators, including a lengthy and costly interconnection process. These constraints, combined with tight reserve margins and generator retirements, have left the market vulnerable to sharp price swings even with moderate demand growth.

Nevertheless, data centers are a major contributing factor. An analysis by Bain & Company in October 2024 found that capital investments necessary to serve U.S. data center growth over the next decade will require utilities to generate 10% to 19% in additional revenue each year than previously forecast, contributing to “extraordinary” growth in electricity rates.

Similarly, an independent study in 2024 for Virginia’s Joint Legislative Audit and Review Commission (JLARC) found that a typical Dominion Energy residential customer could see up to $37/month in higher generation and transmission costs by 2040 due to data centers (real dollars). The report noted:

data centers’ increased energy demand will likely increase system costs for all customers, including non-data center customers, for several reasons. A large amount of new generation and transmission will need to be built that would not otherwise be built, creating fixed costs that utilities will need to recover. It will be difficult to supply enough energy to keep pace with growing data center demand, so energy prices are likely to increase for all customers.

For their part, state officials in Maryland are convinced that data centers are responsible for major new transmission costs. Here is Maryland’s People’s Counsel, David S. Lapp — appointed by the state Attorney General with advice and consent from the state Senate — writing earlier this month in The Baltimore Sun:

The real culprit behind any “supply” issue facing Maryland is the massive projections for the power needs of data centers outside of Maryland. That’s the demand problem that PJM is focused on, which is not Maryland’s problem to solve. If PJM doesn’t solve it correctly, it could impact Maryland, but it would be impractical and economically implausible for Marylanders to bear responsibility for that projected demand growth, not to mention fundamentally unfair to Maryland utility customers.

Unfortunately, this is arriving as electricity costs are already climbing. According to a new analysis by Power Lines, U.S. utilities requested or received $29 billion in rate increases in the first half of 2025 alone — more than double the same period last year and a record year for utility rate increases.

As Robinson Meyer warns in a new piece, “The Electricity Affordability Crisis Is Coming,” “virtually every trend is setting us up for electricity price spikes… Going into 2028, [policymakers] will need an actual plan to stabilize or cut electricity costs.” In testimony to the U.S. Senate Energy & Natural Resources Committee yesterday, Rob Gramlich identified eight separate causes of rising bills, including aging grid infrastructure, scarce generation capacity, severe weather, supply chain constraints, tariffs, termination of federal tax credits, permitting delays, and potential actions forcing uneconomic power plants to run.

Data Centers as Grid Rate‑Relief Valves

But here’s the twist: if we plan them intelligently, the very data centers driving costs today could become one of our best defenses against rising rates.

The reason is this: whether a new load triggers additional costs isn’t primarily about how much electricity it consumes, but when it draws power. Capacity markets, transmission upgrades, and even energy prices are driven by peak demand and congestion at specific times and locations. Give a facility the ability to trim consumption for a limited number of hours each year, and it can often sidestep expensive new generation and wires.

In other words, a small amount of well-timed flexibility — the ability to reduce load for a few dozen hours per year when the grid is most strained — can significantly reduce system-wide costs.

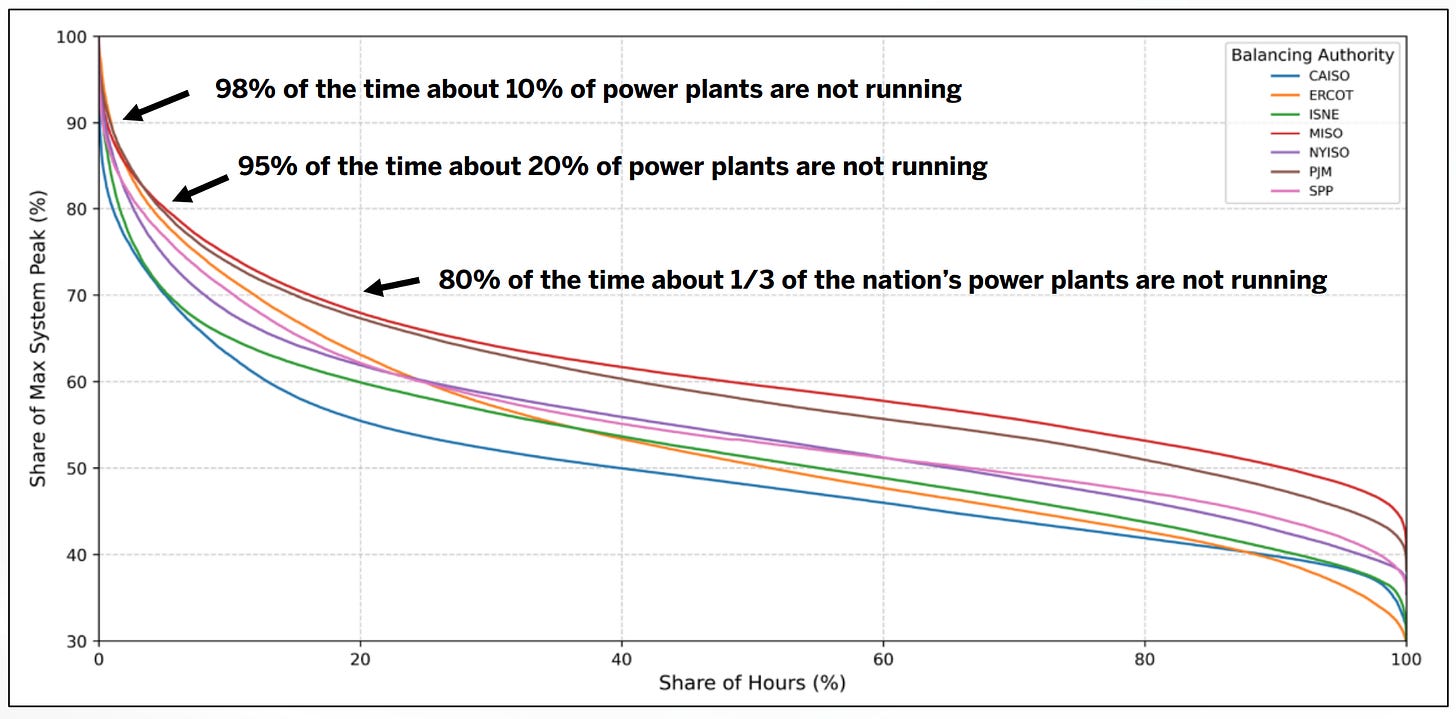

One of the clearest illustrations of this dynamic is the load duration curve, which Constellation Energy adapted from our report for its quarterly earnings call in May (below). What it demonstrates is that our existing power systems are built to serve extreme swings in demand during a small number of hours — specifically, more than 10% of the system is built to serve 35 hours/year of extreme peak load, on average.

Figure 2: Load Duration Curve for US RTO/ISOs, 2016–2024

Think of the power system like a bus that already runs its route whether the seats are full or half‑empty. Most of the costs — the bus, driver, and maintenance — don’t materially change with one more passenger. Flexible loads are the riders who hop on when there’s room, not forcing the operator to buy another bus. They fill empty seats, boosting total kilowatt‑hours served while leaving fixed costs virtually unchanged—so each kWh carries a smaller share of the bill.

That’s the premise of Rethinking Load Growth, where our first-order analysis found that PJM alone could accommodate 13 GW of new load without triggering major new capacity investments, provided the new load is flexible for 0.25% of its maximum potential annual uptime. Most curtailment events would last between 2-4 hours and would entail partial curtailment of the facilities. As we noted:

By strategically timing or curtailing demand, these flexible loads can minimize their impact on peak periods. In doing so, they help existing customers by improving the overall utilization rate—thereby lowering the per-unit cost of electricity—and reduce the likelihood that expensive new peaking plants or network expansions may be needed.

To offer a simplified estimate of potential cost savings from new data center load, consider that Lawrence Berkeley National Lab’s 2024 Data Center Energy Usage report forecasted up to 580 TWh of U.S. data center electricity consumption by 2028, on the high end. Roughly one‑third of our electric bills represent the marginal cost of generating the next kilowatt‑hour, on average, while about two‑thirds pays for fixed costs, including power plants, grid costs, and overhead that doesn’t change when the lights are off. At an average retail electricity rate of 13.2 cents/kWh, 580 TWh of data center load would generate approximately $51 billion in annual contributions toward existing fixed costs of the U.S. power system.

A New Paradigm for Load Planning

Echoing this point, experts at Brattle and Clean Air Task Force note in a new report this week that large load flexibility “can address both resource adequacy and transmission adequacy concerns by quickly connecting loads to power without requiring extensive transmission or generation investments and without raising concerns over unfair cost allocation.”

This is easier said than done, in part because U.S. utilities have rarely if ever planned the power system for flexible loads, building on a century of load planning premised on a “duty to serve” and cost-of-service ratemaking (COSR). As the North American Electric Reliability Corporation (NERC) Large Loads Task Force states in a just-released report:

Large loads interconnecting to the grid typically request firm utility service during the interconnection process. This means that the utility is required to provide the transmission infrastructure capable of serving the load’s peak demand request at all times. Concepts have been explored [23] in some areas around mandatory load curtailments by the ISO or utility during stressful grid conditions, which might allow for TPs to assume a lower peak demand for the load and potentially reduce the transmission buildout exclusively needed to support the load. Utility controllability of loads is usually not accounted for at the transmission planning stage. However, many loads are still expected to obtain firm transmission service to ensure reliable electric service delivery, necessitating transmission buildouts to support the load and an increase in energy supply during both normal and emergency system operations.

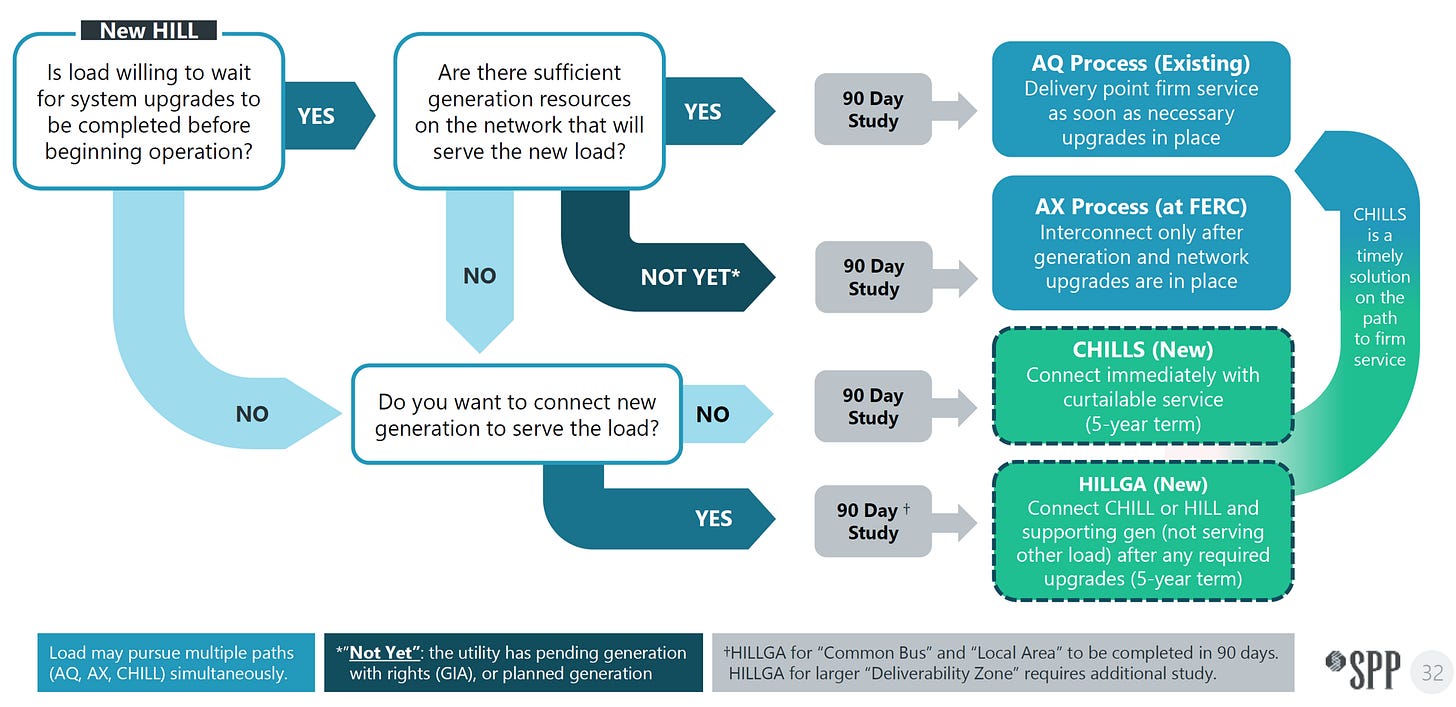

That’s why emerging efforts like PG&E’s FlexConnect program, Southwest Power Pool’s proposed non-firm transmission service (illustrated below), PJM’s proposed co-location service options, Texas’ new SB6 law, EPRI’s DCFlex initiative, Google’s demand response participation, and startups like Verrus, Emerald AI, and Gridcare are so significant — among others.

As Google’s Brian George explained at FERC’s technical conference on resource adequacy last month (emphasis added):

“We have reduced or shifted our loads in response to system events. We also have the ability to shift loads across regions based on demand at a given time. The trick that we’re trying to figure out now alongside those like EPRI and everyone else, is how do we shift this from an operational approach to more of a planning approach. I’ve heard the Duke study referenced several times today and I think there’s a lot of opportunity there. We have the operational capability, but how do we transition that to more of a planning approach – and that encompasses things like backup generation and demand response."

SPP’s Proposed Nonfirm Transmission Services

Answering Rep. Castor’s Question

“Will this help us address the growing concern with additional costs to consumers — to other ratepayers — as AI data centers demand more energy?” That was the verbatim question posed to me by Ranking Member Rep. Kathy Castor on the House Energy & Commerce Energy Subcommittee during my Congressional testimony.

Load flexibility isn’t a silver bullet, and there are a variety of important measures regulators can implement to protect ratepayers and rationalize the large load interconnection process, as outlined in Johns Hopkins University’s recent data center playbook and Harvard Electricity Law Initiative’s March 2025 paper.

But on Rep. Castor’s core concern, my answer then and now is yes: integrating data centers on flexible terms doesn’t just mitigate rate shocks, it can spread the costs of the power system we’ve already built across more kilowatt‑hours and offset upward pressure on bills.

In short, the same server farms now blamed for record capacity prices can become the grid’s pressure‑relief valve — provided that grid planners incorporate flexibility from the start and hold operators to it.

##

Related resources:

“From Bottlenecks to Breakthroughs: Rewriting the Grid Planning Playbook in the Southwest Power Pool and Texas.” Arushi Sharma Frank. Center for Strategic & International Studies. https://www.csis.org/analysis/bottlenecks-breakthroughs-rewriting-grid-planning-playbook-southwest-power-pool-and-texas

“‘AI Fast Lanes’ for an Electricity System to Meet the AI Moment.” Costa Samaras. https://www.cmu.edu/work-that-matters/energy-innovation/ai-fast-lanes-electricity-system-meet-ai-moment

“PG&E tries to prove that a big utility can innovate.” Volts with David Roberts. July 2025. Available here.

“Orchestrating Power for Data Centers with Brian Janous of Cloverleaf.” Build, Repeat - A Paces Podcast. Available here.

“The Key to Unlocking More Data Center Power.” Data Center Richness. May 2025. https://datacenter.libsyn.com/the-key-to-unlocking-more-data-center-power

“Can we add dozens of giant new data centres to the electricity grid?” The Energy Gang. May 2025. https://www.woodmac.com/podcasts/the-energy-gang/can-we-add-giant-new-data-centers-to-the-grid/

“How Load Flexibility Could Unlock Energy Abundance.” Energy Capital with Doug Lewin. April 2024. Available here.